| |

| Orkney IFA Ltd are directly

authorised and regulated by the Financial Services Authority |

|

|

|

|

What are the different ways of repaying a mortgage?

Most mortgage types are available on “repayment mortgage” or “interest only” payment schemes. Sometimes, a loan may be partly “repayment” and partly “interest only”. Here’s what the jargon means, and a summary of the advantages and disadvantages:

|

Explanation |

|

Repayment mortgage (a.k.a. “Capital and Interest” mortgage). |

Your monthly payments gradually pay off the amount you owe as well as paying the interest charged on the loan. Provided you make all the agreed payments, the loan will be fully paid off by the end of the mortgage term, like this:

This is the only way of guaranteeing that your mortgage will be repaid at the end of the term – if you make all the payments, it will be repaid.

|

|

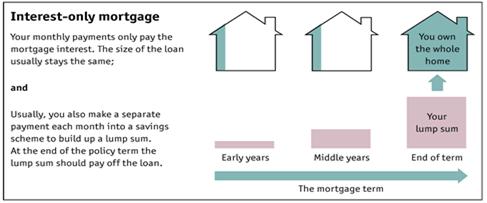

Interest Only mortgage |

Your monthly payments cover only the interest on the loan and don't pay off any of the capital. It'll be your responsibility to arrange to pay separately into a savings or investment scheme to build up a lump sum to pay off the mortgage at the end of the term. Here’s how it works:

There is a risk your mortgage will not be repaid at the end of the term and you should plan for this. Furthermore, you’ll pay much more interest over the whole term on an “interest only” mortgage because you don’t repay any capital during the life of the mortgage.

|

Your home may be repossessed if you do not keep up repayments on your mortgage

Back to Mortgage Home Page

|